- Home

-

Product System

-

Solutions

-

Risk Control Compliance

-

Information Security

-

About Us

2019 9.24 SCA New Regulations Is Officially Implemented.

SCA (Strong Customer Authentication), as part of the PSD2 regulation, requires e-commerce transactions in Europe to be authenticated by two separate forms of Authentication from 14 September 2019. The forms of Authentication include: Customer knows (password, etc.); Customer owned (equipment parameters); Biometrics (facial recognition, etc.).

-

PSD 2

On 13 January 2019, the Payment Service Directive 2 (PSD2) will come into force across the EU. It aims to make payments more secure, ensure fair competition, increase consumer protection and make shopping easier.

-

3DS 2

Compared with 3DS 1, 3DS 2 has a wider application range, more flexibility, and can adapt to the needs of different countries and different regulatory systems. The newly upgraded 3DS 2 identifies and determines the compliance requirements for each transaction, helping merchants navigate regulatory rules.

Certification Form

-

What The Customer Knows (password, etc.)

-

What The Customer Owns (equipment parameters, etc.)

-

Biometrics (facial recognition, etc.)

-

3DS 1

-

3DS 2

-

Data Diversification

Merchants need to collect high-quality and richer data, such as the device information used by customers when shopping, facial recognition, location data, etc. to assist the issuing bank to make more accurate trading risk decisions.

-

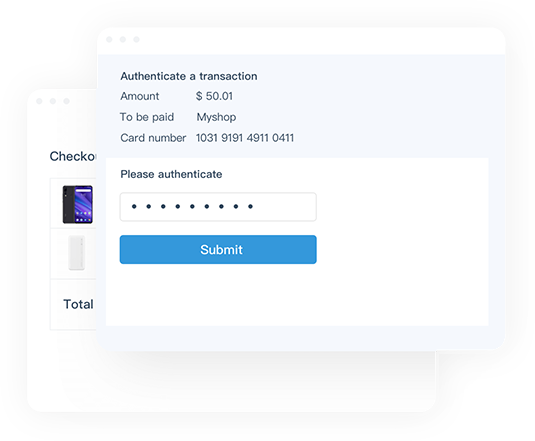

Improved Payment Process

In 3DS 2, if the relevant data can support the risk decision, the customer does not need to verify in other ways. At this time, the customer has no perception of verification. When the customer needs to enter an OTP or a static password, the page does not need to be forced to redirect and can be seamlessly embedded in the merchant application.

-

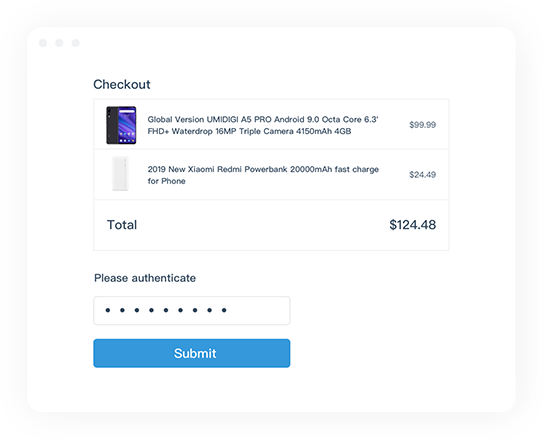

Conversion Rate Improvement

In the 3DS 1 verification process for compulsory authentication of page turn, customers often encounter various problems when paying; The verification code was not received, and the page of the consumer did not turn back to the merchants page after the verification. The mobile terminal could not automatically adapt, resulting in a low conversion rate. 3DS 2 supports multiple terminals, complete transaction security authentication without forced page turn.

Our Advantages

-

Support for multiple scenarios

Support merchants for 3DS 2 verification only, 3DS 2 transaction, 3DS 2 verification and transaction, single or combined use in intelligent 3D multi-scene.

-

One-stop service

Merchants only need to conduct one connection to complete the development of 3D2.0 related businesses, without affecting the opened businesses.

-

Seamless compatibility

3DS 1 and 3DS 2 are automatically compatible, and iPayLinks provides a unified interface and unified content.

-

Experience improved

The docking capacity of different terminals (APP, mobile phone terminal, PC terminal, etc.) will be provided, and the professional team will provide appropriate service content according to the specific needs of merchants.